CAGR Full Form | What is Compound Annual Growth Rate

What is the full form of CAGR

CAGR: Compound Annual Growth Rate

CAGR stands for Compound Annual Growth Rate. It refers to the rate of return required for an investment to grow from its initial value to its ending value if the profits were reinvested at the end of each year of the investment's lifespan, i.e., when the investment has been compounding over the time period. So, it is a measure of growth over multiple time-periods that measures the total return on investment by calculating the return every year and compounding them. We can say that it is the annual growth rate of an investment over time when the effect of compounding taken into account. However, CAGR does not reflect investment risk.

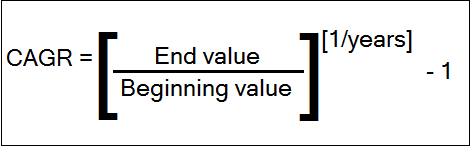

The Formula and Calculation of CAGR:

CAGR = (EB/IB) 1/n - 1

1/nWhere:

Where:EB = Ending Balance

IB = Initial Balance

n = Number of years

To calculate the CAGR of an investment:

- Divide the ending value of the investment by its initial value

- Raise the result to an exponent of one divided by the number of years

- Subtract one from the result

Benefits of CAGR:

- It is the most accurate way to calculate returns for any investment whose value may increase or decrease over time.

- It allows investors to compare the CAGR of two alternatives to evaluate their performance against other investments or a market index.

- It is not influenced by percentage changes within the investment horizon that may give wrong results.

- It is considered an accurate way to measure the overall return on investment than using an average returns method.