CRR Full Form | What is Cash Reserve Ratio

What is the full form of CRR

CRR: Cash Reserve Ratio

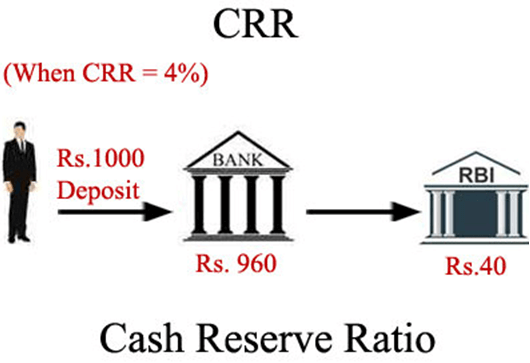

CRR stands for Cash Reserve Ratio. It refers to the cash that banks have to maintain with the Reserve Bank of India (RBI). It is a certain percentage of the total cash held by a bank.CRR keeps changing from time to time. RBI decides the CRR and accordingly banks have to keep a certain percentage of their deposits with RBI.

The commercial banks are required to maintain an average cash balance with the RBI. This balance should not be less than 3% of the Net Demand and Time liabilities (NDTL) on a fortnightly basis. The RBI is empowered to increase the CRR up to 20% of the NDTL.

The main objective of CRR is to enable banks to maintain their solvency and liquidity. It is a crucial tool that helps control the money supply in an economy. It enables RBI to suck excess liquidity and to release funds in case of low liquidity in the system. So, a higher CRR tends to decrease the liquidity in the system and a lower CRR tends to increase the liquidity in the system. The current CRR as of July 2017 is 4%. The average CRR from 1999 until 2017 is 5.57%. It was highest (10.50 %) in March 1999.