ADR Full Form | What is American Depository Receipt

What is the full form of ADR

ADR: American Depository Receipt

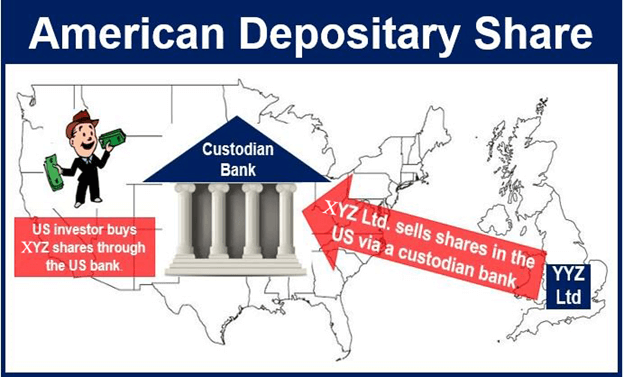

ADR stands for American Depository Receipt. This term is used in the context of stock markets. It is a receipt or certificate that represents shares of a foreign stock. It is issued by a U.S. bank to a person who is interested in buying shares of a foreign stock or non-US Company through U.S. stock exchange. ADR was introduced in 1927 to offer U.S. investors an easier way to buy stocks of foreign companies.

ADR is issued and pays dividend in U.S. dollars which allows domestic investors to own shares of a foreign company without the hassle of currency conversion. It also helps foreign companies attract American investors by trading on U.S. stock exchanges. The shares represented by an ADR are called American depositary shares (ADSs).

How does it work?

ADRs are shares of a foreign company owned and issued by a U.S. Bank. The U.S. banks buy the shares of a foreign company then sell these shares on the stock exchanges of the U.S. (NYSE, NASDAQ and AMEX) in the form of ADRs. Each receipt has a certain number of underlying shares (one or more) in a foreign corporation. The investors who want to buy the shares of a foreign company can buy these receipts. So, ADRs are traded just like shares which can be purchased through the stock exchanges of the U.S.

ADR Benefits for Foreign Companies:

- They gain access to capital in the U.S without the hassle of regulatory filings of the U.S. Securities and Exchange Commission (SEC).

- Their corporate visibility increases in the U.S.

- They can diversify their shareholder base.

- They can expand their share market and improve global liquidity.

ADR Benefits for Investors:

- They can diversify their investment portfolio on a more global scale.

- They can exchange following the American conventions.

- They receive dividends payments in American dollars.

- They can clear ADRs through U.S. settlement systems.

- Trading related information is available for the investors.